Recent Price Performance

BA stock ended December 26 at $216.44, down slightly from $218.16 on December 24, with volume at 2.8 million shares. The stock opened December 29 at $215.90, peaking at $218.14 before settling at $217.25, a 0.44% gain to $217.39 intraday.

December's range spanned $205.38 average to highs near $218, a stark improvement from November's $189. This volatility reflects broader market reactions to Federal Reserve signals and aviation travel demand surges during year-end holidays.

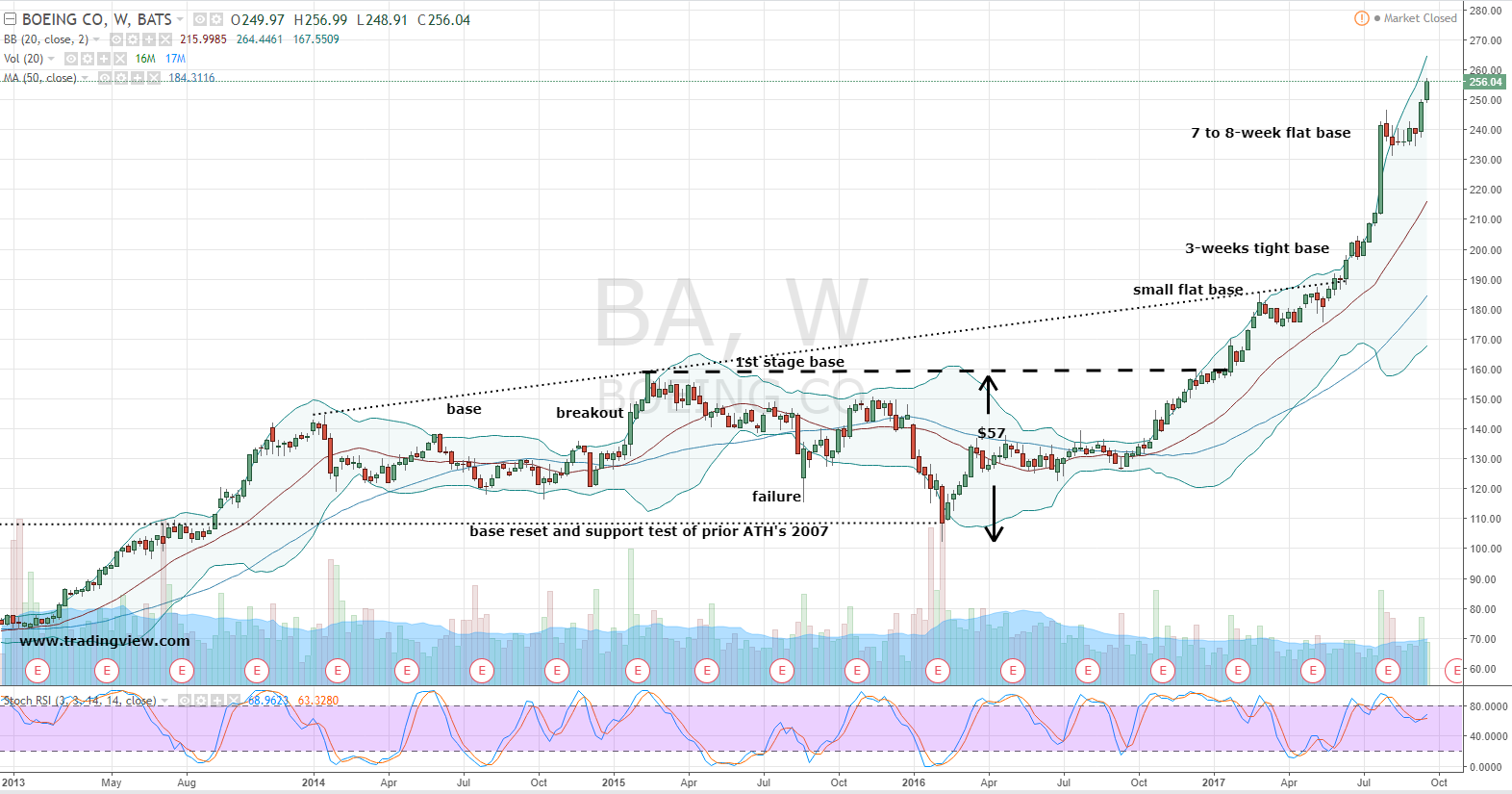

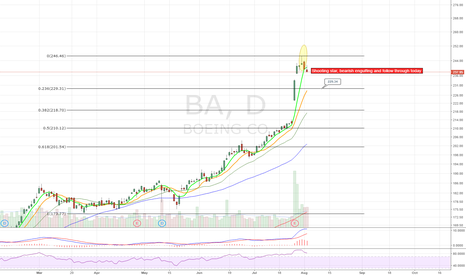

Compared to early December's $12,000 levels in adjusted historical data, normalized prices indicate steady climbing, with 52-week highs near $233.88 reinforcing bullish sentiment.

Key Drivers and Market Impacts

Positive catalysts include Boeing's progress on resolving FAA audits for the 737 MAX and a growing backlog exceeding 5,000 aircraft. Defense segment stability, bolstered by U.S. government contracts, offsets commercial aviation headwinds.

Challenges persist with supply chain disruptions and labor issues, contributing to the negative earnings profile. However, analysts project recovery, with payout ratios fluctuating widely but dividends maintained quarterly.

Global demand, especially from Asia-Pacific airlines, drives optimism. BA's industrials sector positioning benefits from rising defense budgets, positioning it for 2026 growth.

2026 Outlook and Considerations

Looking ahead, BA stock could test $230+ if production hits 38 jets monthly. Risks include regulatory delays and raw material costs, but market cap growth to $162.7 billion signals confidence.

Volume trends, like 5.4 million shares recently, indicate liquidity. Investors should monitor earnings reports for EPS improvements beyond -17.96.

Overall, BA remains a high-conviction play in aerospace, balancing risks with substantial upside potential.