Recent Performance and Lows

Costco stock has faced headwinds, decreasing to $871.86 on December 25, 2025, the lowest since April 2025. Over the past four weeks, shares lost 4.01%, and over 12 months, they declined 8.79%.[1]

Earlier in December, the stock hit a 13-month low of $871.66 and a 35-week low of $873.89. These drops reflect volatility, with December 2025 averaging around $922.26 monthly, down from November's $913.59.[1][4]

Compared to peers like Amazon and BJ's Wholesale, Costco underperformed recently, with year-to-date losses contrasting sector gains in some areas.[1]

Historical Trends and Context

Historically, COST has shown strong growth, rising from under $50 in 2005 to over $900 in 2025. However, 2025 saw a reversal, with shares falling from October's $911.45 to current levels.[4]

At close on December 24, 2025, the price was $871.31, down 0.06%. Pre-market on December 26 hovered near $871.86, indicating limited rebound.[2]

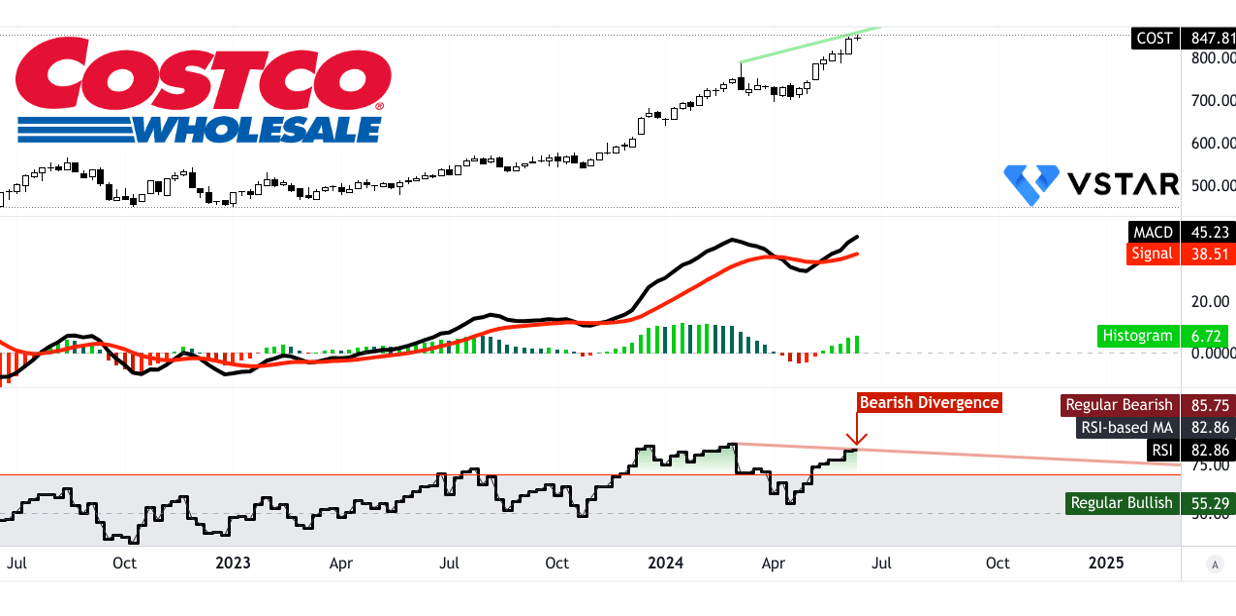

Long-term charts reveal resilience, but recent 4-week losses of 4.58% and 12-month drops of 12.29% highlight current challenges.[1][3]

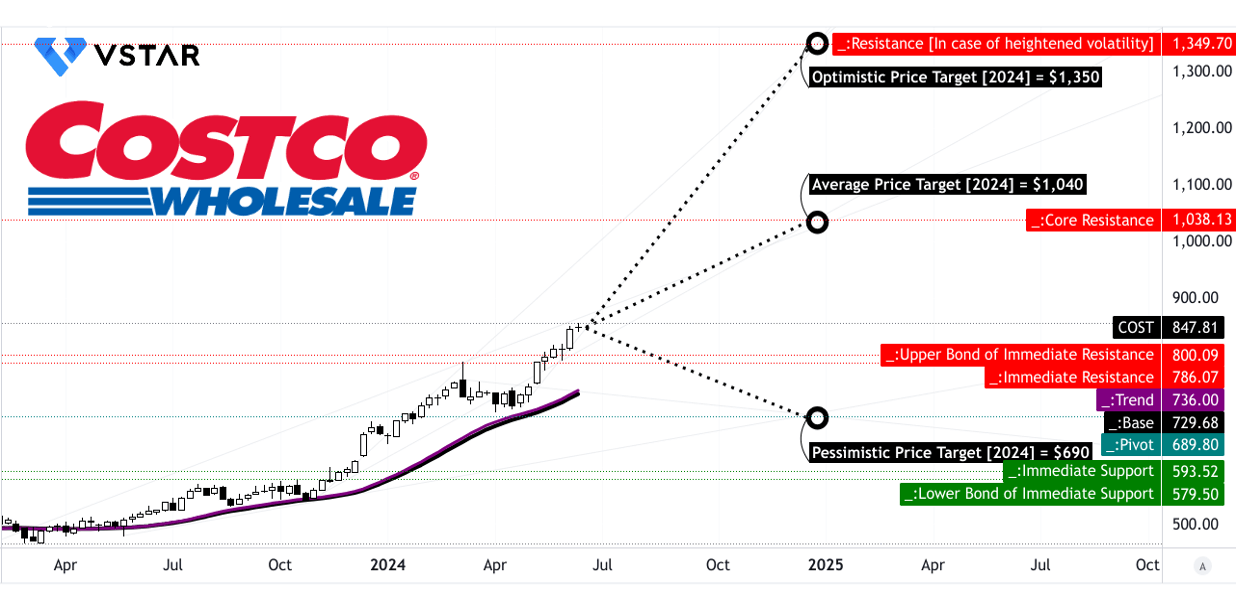

Forecasts and Outlook

Analysts forecast Costco stock at $828.58 by quarter-end and $752.49 in one year, based on global macro models. This bearish outlook follows consistent downward revisions.[1]

Daily data from Investing.com shows volatility, with recent sessions fluctuating between $858 and $876. Investors watch for holiday sales impacts post-December 25.[3][5]

Despite lows, Costco's fundamentals like membership growth could support recovery, though market sentiment remains cautious amid broader retail sector shifts.[1][2]