What “Mortgage Rates News” Means Today

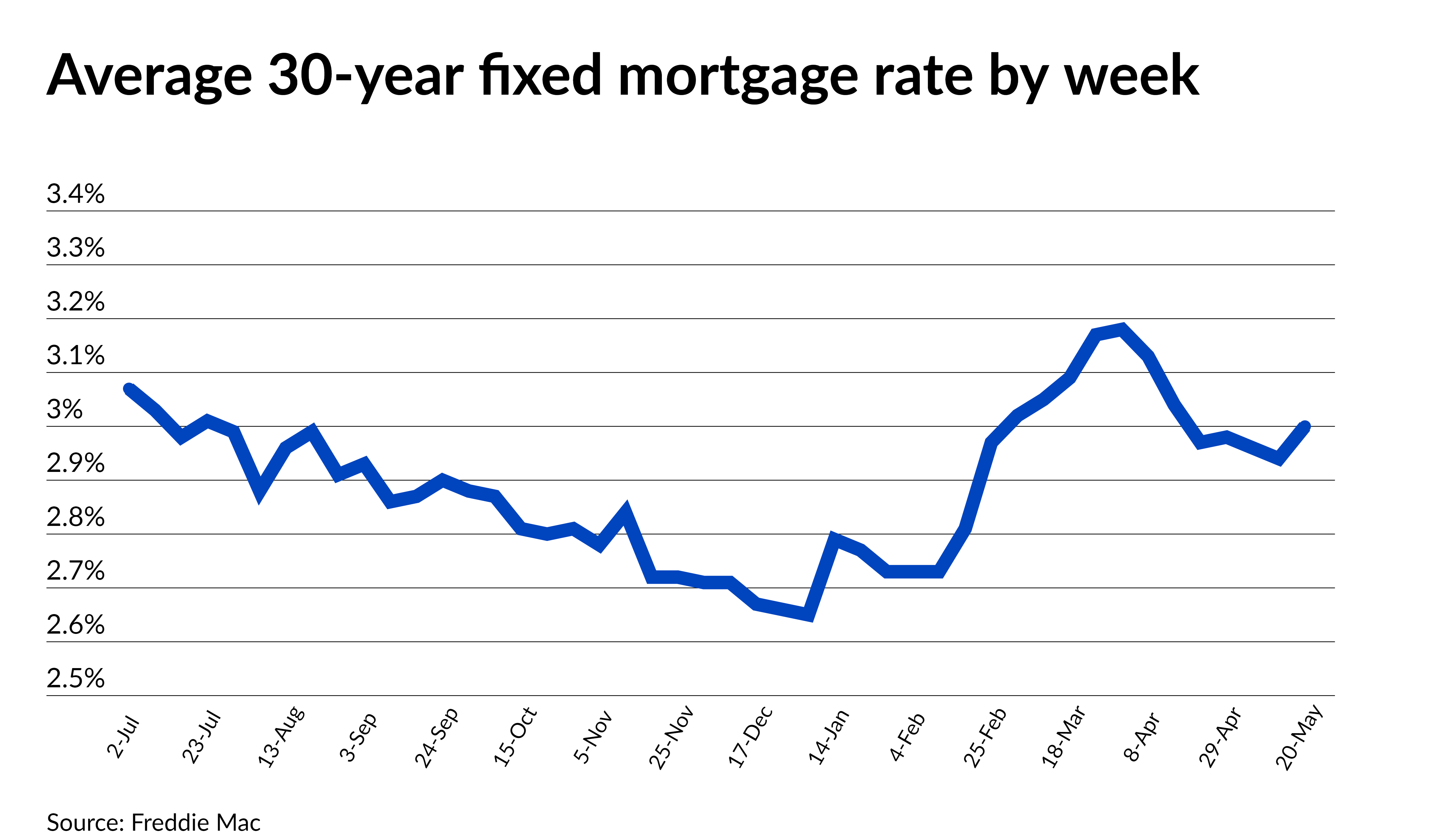

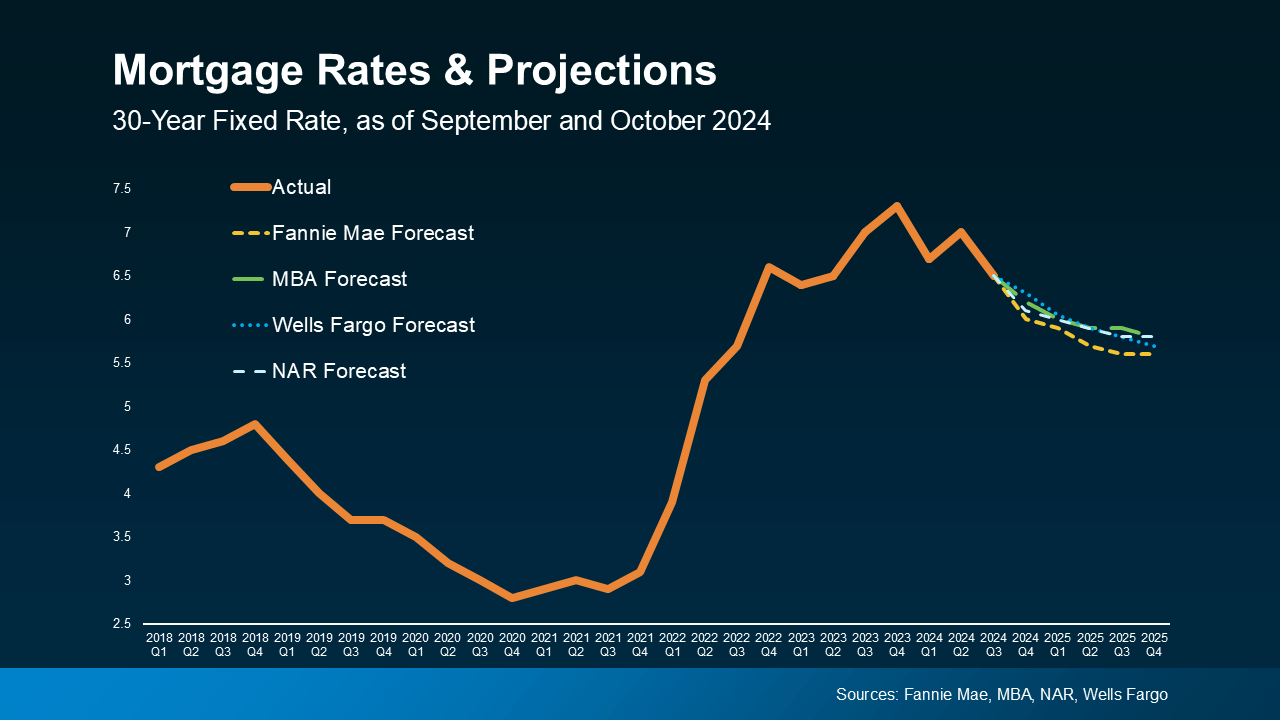

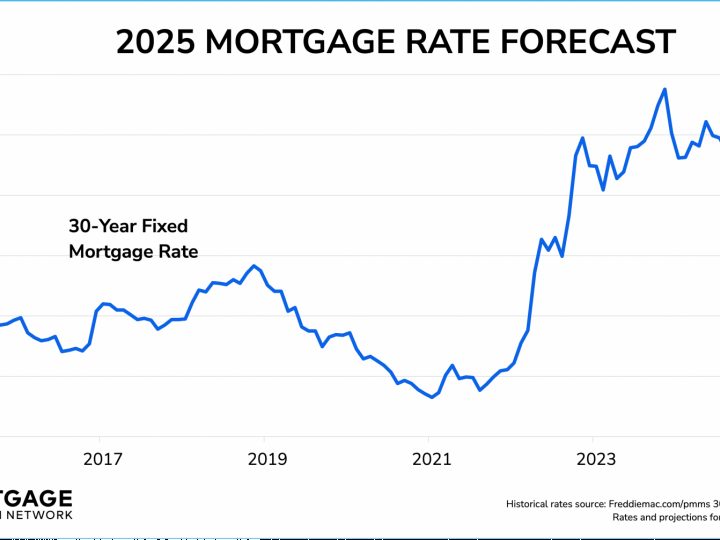

Mortgage rates news covers the latest moves in home loan costs, focusing on how average 30-year and 15-year fixed-rate mortgages change from day to day and week to week. After spending much of 2025 closer to 6.7%, national averages have recently eased into the low 6% range, giving borrowers slightly more breathing room.[1][2][7]

Current surveys show the average 30-year fixed rate near 6.1%–6.2%, while 15-year fixed loans are in the mid‑5% range, both lower than a year ago.[1][2] Although these levels remain high compared with the ultra‑low rates of the early 2020s, the recent decline marks an important shift in the direction of borrowing costs.

Today’s Mortgage Rate Trends and Drivers

Daily and weekly indexes indicate that 30-year fixed mortgage rates have slipped from roughly 6.7% earlier in the year to just above 6.1% APR, with 15-year loans also moving lower.[1][2][7] National data series confirm that the latest readings near 6.19% are below both last week’s levels and those from the same time a year ago.[2][4]

These moves are closely tied to shifts in bond yields and expectations for Federal Reserve policy. When Treasury yields fall on softer inflation or weaker economic data, lenders can offer lower mortgage rates; when yields rise, mortgage pricing usually follows.[3][5] Lender‑specific offers still vary based on credit scores, down payments, and loan type, but the broad trend has been a modest decline from 2025 highs.[1][6]

Impact on Homebuyers and Refinancers

For homebuyers, slightly lower mortgage rates translate into improved affordability, reducing monthly payments and sometimes expanding the price range they can consider. However, with home prices still elevated and inventory tight in many markets, the rate relief has not fully overcome broader affordability pressures.[1][7]

Homeowners who locked in loans near or above 7% earlier in the cycle may now find refinancing into the low‑6% range attractive, especially on larger balances or long remaining terms.[7] By contrast, borrowers who secured sub‑4% pandemic‑era mortgages still have little financial incentive to refinance, which helps explain why overall refinance activity remains subdued despite the recent easing in rates.[7]