Recent Price Performance

MU stock experienced significant volatility in early December 2025. On December 9, it reached $264.75, but dropped to $244.49 by December 10, then fluctuated between $255 and $262 through December 12.[1][3]

By December 15, shares closed at $237.50 on volume of 27.5 million shares, down from $241.14 on December 12. The latest close on December 16 at $232.51 signals continued downward pressure.[5][1]

This pullback comes after a strong run, with December monthly average around $240.46, highlighting short-term corrections in a bullish long-term trend.[2]

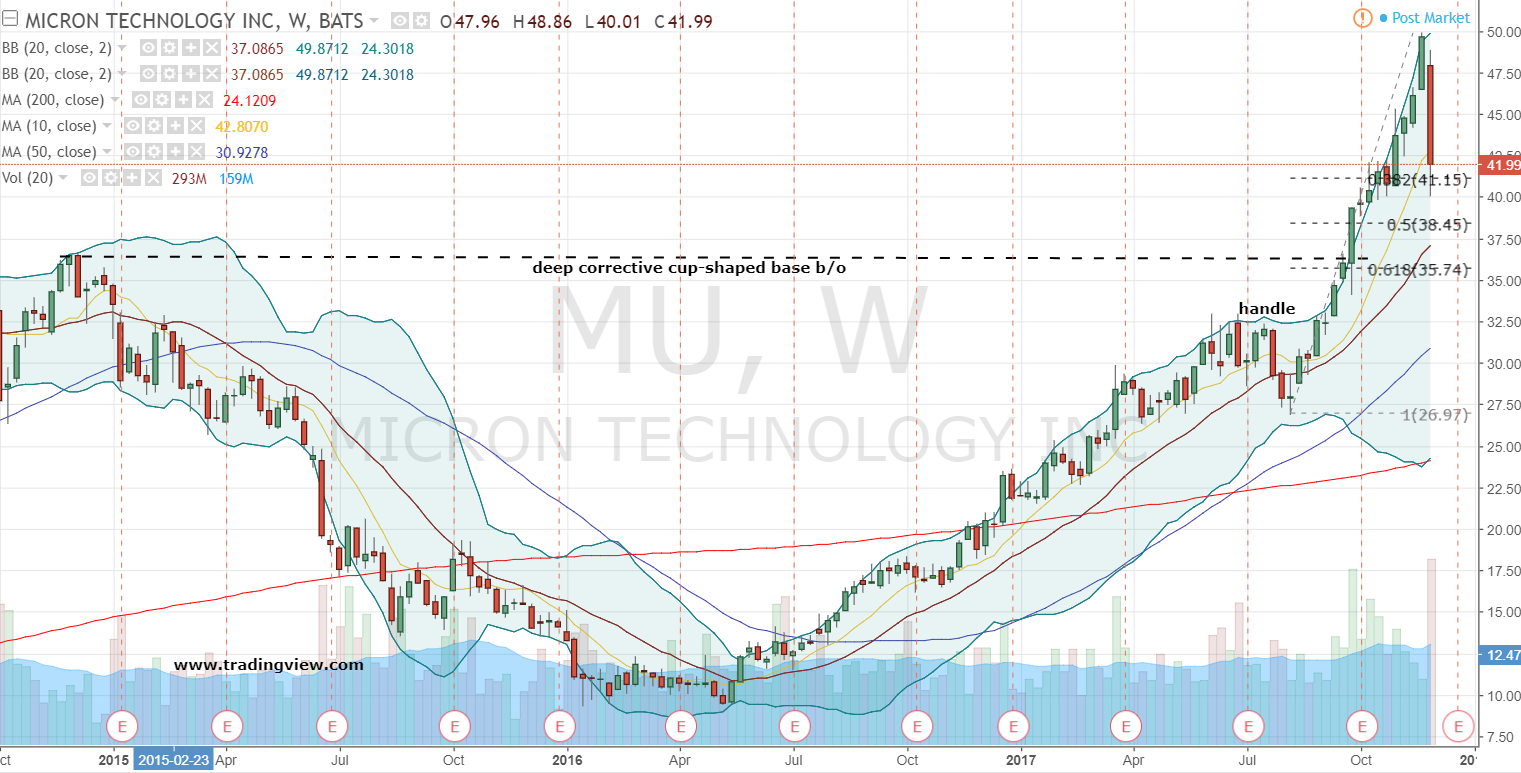

Historical Context and Trends

Over decades, MU has grown from lows of $0.34 in 1986 to recent highs above $260. In 2025, it averaged $223.77 in October, rising to $240.46 in December, driven by memory demand.[2][6]

Earlier peaks include 1990s surges to adjusted highs near $80, but adjusted for splits, today's levels reflect massive growth. Recent data shows resilience amid cycles.[1]

High volume days like December 15 (27M shares) indicate strong investor interest despite dips.[5]

Market Impacts and Outlook

The 2.10% drop on December 16 may tie to broader tech sector pressures, but Micron's AI-focused products position it for recovery. After-hours uptick to $233.25 suggests potential rebound.[1]

Key drivers include demand for high-bandwidth memory in data centers. Analysts track earnings and supply chain news for directional cues.

With global/US focus, MU remains a bellwether for semiconductors, warranting close monitoring amid 2025 volatility.[4]