Background and Rise to Treasury Secretary

Scott Kenneth Homer Bessent was born in 1962 and rose to prominence in finance as a global macro investor. After working on Wall Street, he joined George Soros’s operation and eventually became chief investment officer at Soros Fund Management, helping oversee large currency and macro bets that cemented his reputation in international markets.

After leaving Soros, Bessent founded Key Square Group, a global macro hedge fund that managed billions of dollars and focused on big-picture themes in currencies, interest rates, and geopolitics. His investor letters and media commentary built an image of a data-driven strategist with strong views on U.S. competitiveness, monetary policy, and the role of the dollar in the world economy.

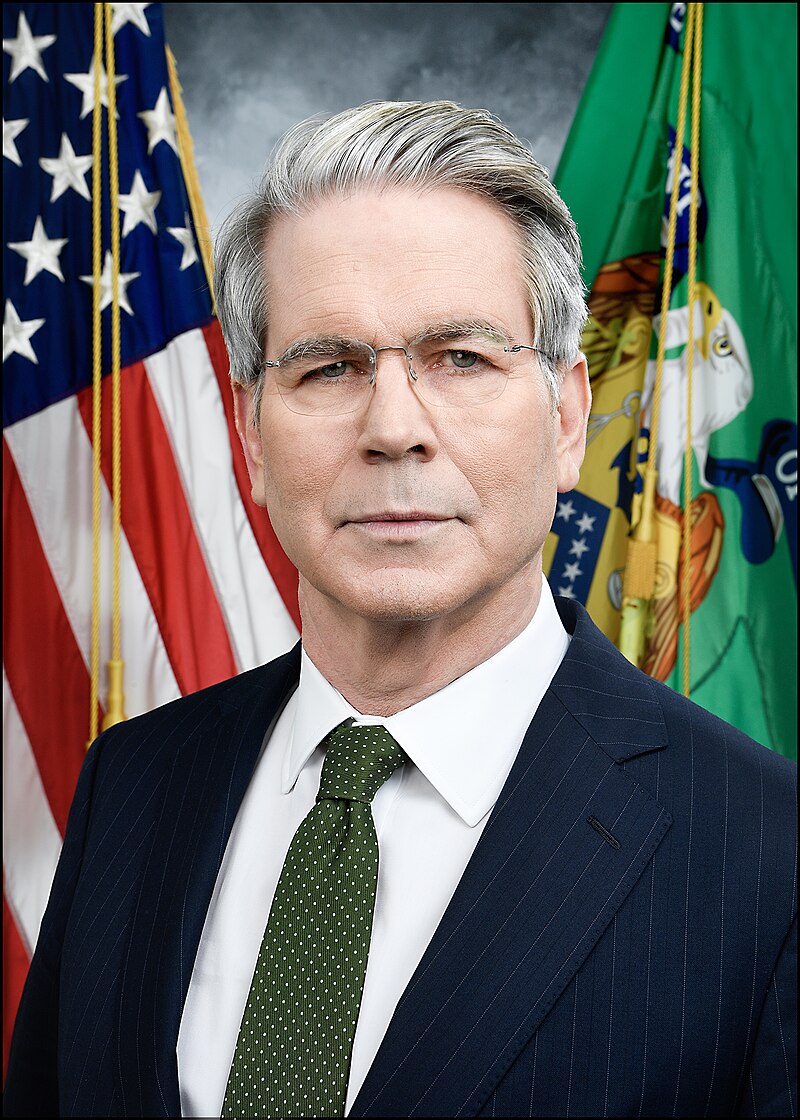

Bessent later emerged as an influential supporter of Donald Trump. He served as an economic adviser and major fundraiser for Trump’s 2024 campaign, aligning himself with a platform that emphasized growth through tax cuts, deregulation, and a tougher line on trade and immigration. Following Trump’s victory, the president-elect announced Bessent as his nominee for Treasury Secretary, and the Senate confirmed him by a wide bipartisan margin in January 2025.

Policy Agenda and Current Economic Initiatives

As Treasury Secretary, Bessent has promoted an agenda centered on extending and deepening tax cuts, using tariffs as leverage in trade negotiations, and rolling back regulations he argues stifle lending and investment. In public appearances, he has described his views on tariffs as having “evolved” from skepticism of broad duties to a belief that targeted, high-impact tariffs can force trading partners to the table while financing domestic tax relief.

Bessent has also played a leading role in efforts to establish a U.S. sovereign wealth-type vehicle, designed to pool federal assets and foreign capital into long-term investments that support American growth and strategic partners. At the same time, he has backed initiatives to channel large-scale private philanthropy and investment into accounts for children and education, pitched as a way to broaden opportunity without expanding traditional welfare programs.

On the regulatory front, Bessent has focused on loosening what he and the administration describe as overly tight credit conditions. He has advocated closer coordination between Treasury, banking regulators, and the Federal Reserve to ease lending constraints while warning that purely private credit markets can become pro‑cyclical and destabilizing in downturns. His approach blends deregulatory rhetoric with a willingness to use federal guidance to shape how banks and markets respond to economic stress.

Controversy, Identity, and Global Impact

Bessent’s tenure has not been free of controversy. Ethics watchdogs have raised concerns about the timing of his compliance with divestment and conflict-of-interest commitments tied to his hedge fund and investment holdings. He has also drawn fire from opponents for moves to halt work at the Consumer Financial Protection Bureau and to reclassify certain tax credits as federal public benefits in ways that could restrict access for undocumented immigrants.

Internationally, Bessent has taken an unusually activist stance in emerging‑market crises. He led a Treasury-backed program to purchase Argentine government bonds as a $20 billion lifeline, followed by efforts to organize additional private and sovereign wealth investments into the country. Supporters say this demonstrates creative use of U.S. financial power to stabilize allies, while critics question the risk and precedent of such direct interventions.

Bessent’s identity as an openly gay, conservative Treasury Secretary has also drawn attention. LGBTQ outlets and civil rights advocates have highlighted the symbolic importance of an openly gay official at the helm of U.S. economic policy, even as some disagree with his alignment with Trump and his hard-edged positions on immigration and regulation. Taken together, his market background, activist policy style, and personal history make him one of the most closely watched economic policymakers in the world today.