Current Price and Daily Performance

Tesla (TSLA) closed the December 16, 2025, trading session with significant gains, reaching $475.16 after a $1.65 or 0.35% increase from the prior day. Intraday highs touched $473.70, with real-time quotes showing $479.63 up 0.91% by midday EST.[1][2]

Over the past four weeks, TSLA has surged 16.64%, far outpacing its yearly performance of -0.59%. This follows a 51-week high of $481.06 hit recently, signaling strong bullish sentiment.[1]

Compared to peers like Apple at $272.82 and other automakers, Tesla's volume exceeded 230 million shares, highlighting intense investor interest.[1][3]

Recent Trends and Future Forecasts

Historical data shows TSLA opening at $472.21 on December 16, with a high of $473.70, building on December 15's range of $469.44 to $481.77. Monthly averages for December stand at $454.93, up from November's $430.17.[2][3]

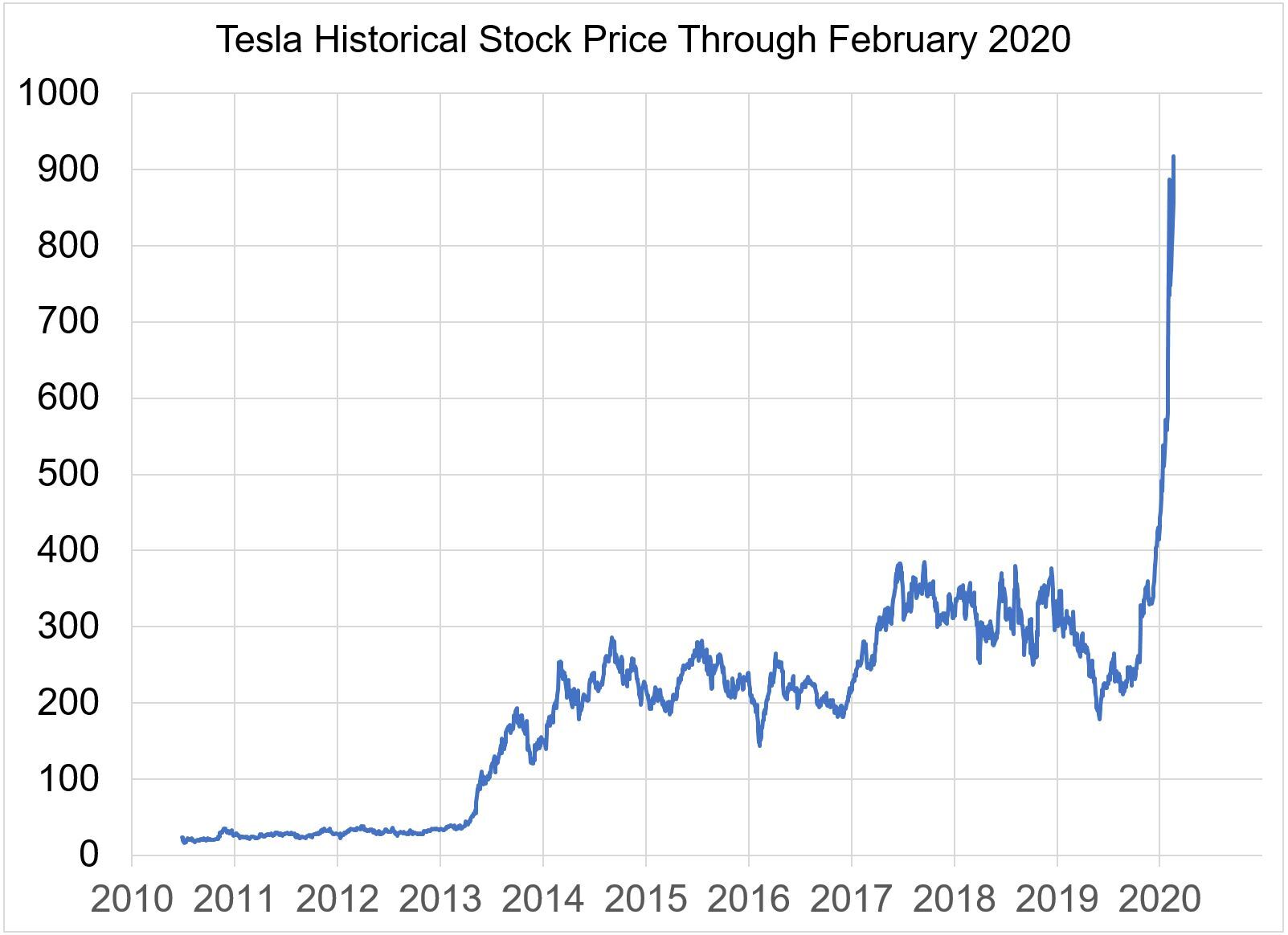

Yearly context reveals a 52-week range of $182.00 to $488.54, with current levels near the upper end. Earnings per share sit at $1.68, supporting a high P/E ratio of 188.13 amid growth expectations.[3]

Analysts forecast a Q4 price of $444.46 and $403.64 in one year, based on macro models, though short-term momentum suggests potential for further upside.[1]

Market Impact and Investor Insights

Tesla's surge impacts the broader NASDAQ, with indexes like USND down 0.33% while TSLA drives EV sector gains. Market cap exceeds $1 trillion, reinforcing its dominance.[1][3]

Recent news highlights a 19.18% four-week gain to $481.06, contrasting earlier dips like the November 4-week low of $413.72. This volatility underscores Tesla's sensitivity to news on Cybertruck production and Full Self-Driving updates.[1]

For investors, TSLA remains a high-risk, high-reward play, with pre-tax profits at $1.55B and sales of $28.1B fueling optimism despite trade creditor pressures.[1]