What the Wealthfront IPO Means

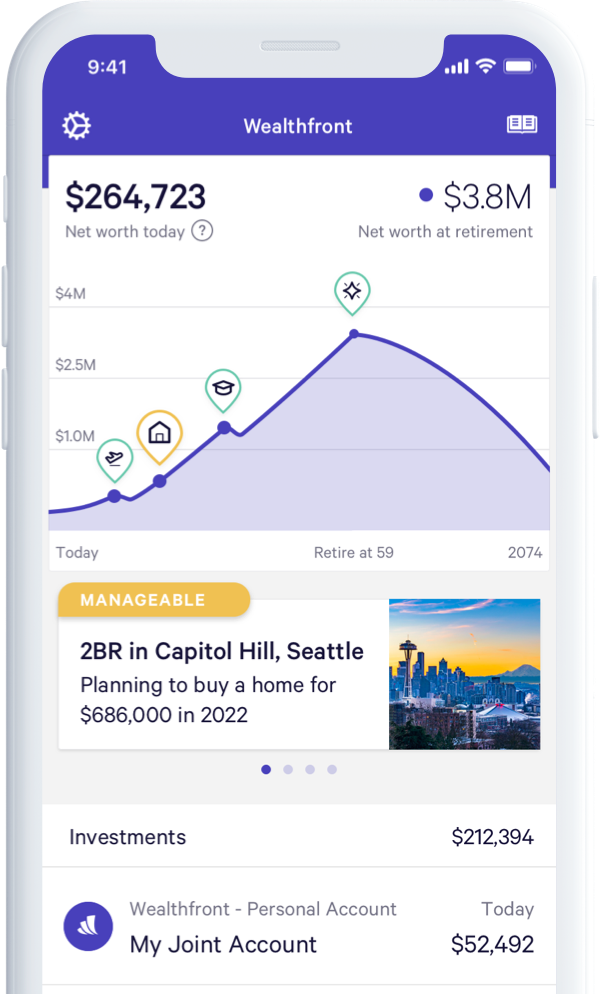

The term “Wealthfront IPO” refers to the initial public offering of Wealthfront, a U.S.-based robo-advisor and digital wealth-management platform that has now listed its common stock on a major U.S. exchange. This step moves the company from private, venture-backed status to a publicly traded fintech that any eligible investor can own through the stock market.

By going public, Wealthfront gains access to a broader pool of capital and a visible market valuation, while its early investors and employees receive a pathway to liquidity over time. The IPO also places the company under the heightened disclosure and governance requirements that apply to all U.S.-listed firms.

IPO Pricing, Valuation and Use of Proceeds

Wealthfront priced its IPO at $14.00 per share, raising roughly $485 million in gross proceeds according to news reports, and implying a multi‑billion‑dollar equity valuation. The pricing came after a marketing roadshow to institutional investors, who weighed the company’s rapid asset growth against ongoing operating losses and competitive pressures in fintech.

In its offering documents, Wealthfront said it plans to use the funds for general corporate purposes, including product innovation, technology investments and possible expansion of its banking and advisory features. Strengthening the balance sheet also gives the firm more resilience against market downturns that can temporarily reduce assets under management and fee revenue.

Risks, Market Outlook and Investor Takeaways

Wealthfront’s public-market debut comes amid mixed sentiment toward fintech IPOs, with some peers experiencing sharp post-listing volatility. Key risks highlighted by analysts include fee compression, intense competition from brokerages and other robo-advisors, and regulatory changes affecting digital advice and cash products. Market declines can also hurt assets under management, directly impacting revenue.

For investors evaluating the Wealthfront IPO, the central questions are whether the company can sustain strong user and asset growth, improve operating leverage and eventually reach consistent profitability. Comparing its valuation to other listed fintech and asset-management firms, and closely tracking its quarterly disclosures on assets, revenue and costs, will be crucial in judging whether the stock offers attractive long-term risk–reward.